On this page Show

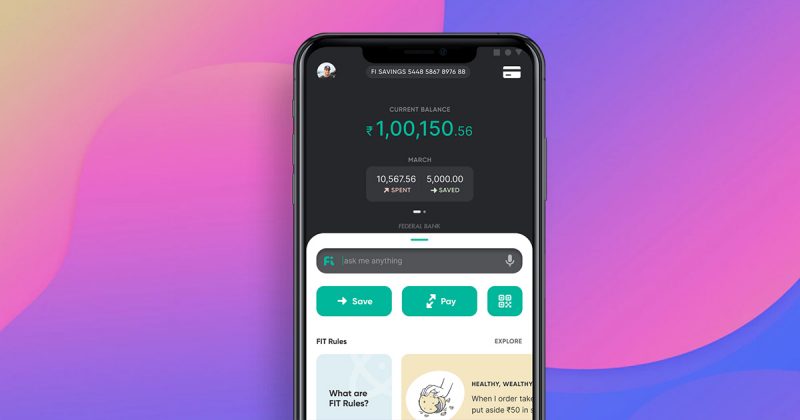

Fi Money is a new-age digital savings bank account that helps millennials and GenZ manage their finances better. Fi is a popular name in the industry of banking today; it is streamlining the hassle of banking for working professionals by saving their time and labour. The Fi app includes various features and options, making it especially useful for those who are familiar with the digital world and how it works.

Fi Money has built-in saving account options, a zero-balance savings account, and an auto bot that allows consumers to create and modify rules to automate the process of saving, paying, and reminding.

In this article, we will dedicatedly talk about Fi Money. Here is our review of the Fi Money app, where we delve deep into the pros, cons, rewards, cashback, and more. We attempt to answer the question of whether this is the right digital savings account for yourself or not? Here you can also check jupiter money review.

Fees and Charges

| Cash withdrawal charges | Rs 100 |

| Debit card charges | Nil |

| Cash deposit charges | |

| Account closure charges |

Pros & Cons

Interest Rates and Rewards

- Interest rate: 2.5% per annum on the Fi Money digital savings account

- Rewards: Each spend on Fi Money gets you rewards that can be redeemed in the form of Fi Coins. No specific reward rates.

Who should use Fi Money?

Customers who are eyeing a zero balance digital savings account with zero to minimum liabilities can opt for Fi Money. Fi Money has basic features and free international transactions. However, Fi Money is not a fit as a full service bank, and you need to identify what elements of FI Money can work for you and then only put your faith in it.

Fi Money digital savings account has a great banking app with a smart AI assistant that can rapidly discover transactions, bills, and other information needs all together with a pleasant in-app experience.

Eligibility criteria

1. Age

Applicant should be at least 18 years old

2. Location

Indian Resident

3. Documents required

- PAN Card

- Aadhaar Card

- Passport/ Other identity Verification documents

Conclusion

Fi is transforming into a one-stop solution services application. Fi is the neo banking setup for digital natives, with a simple UPI mechanism and sleek VISA debit card with no forex markup fees. The company offers digital savings accounts with no minimum balance and cutting-edge technology to allow consumers to manage and organise their accounts with no effort.

Ratings and Reviews

- Safety & security – 4/5 When it comes to safety and security, Fi claims to follow exceptionally high standards of confidentiality when using clients’ data or payments. Apart from personalisation, Fi also tries to improve data privacy and offer protection against the exploitation of client data as well.

- Reward points – 3.5/5 Fi offers a well-structured technique to develop excellent saving and reward-earning habits; rewards are available in cashback or Fi coins, which can be redeemed at major retailers such as Starbucks, BigBasket, etc. The issued debit card can also be used everywhere, where Visa is accepted.

- Overall – 4/5 The Fi Money digital savings account is the best option for those looking for a no-frills, hassle-free banking experience that gets you rewards as you transact.

FAQs

Is Fi Money Safe?

Yes, Fi Money is secure. It is tied to and backed by the Federal Reserve, and the RBI has approved it. You also get the Rs 5 lakh RBI account guarantee when you open a new Fi Money digital savings account.

Is Fi money RBI approved?

Fi is not a financial institution. It’s a Neobank service that allows you to get financial help via an app. The RBI has given its approval. The Federal Bank, affiliated with the RBI, is linked to the app.

How do I convert my Fi coins to cash?

Fi Money gives Fi coins to businesses and third-party apps with every transaction. Fi coins can be used to claim third-party offers, vouchers, and more. But, Fi Money recently added a new tool that allows you to convert your Fi coins into cash.

1. To begin, download or update your Fi money app on Android or iOS.

2. Launch the app and sign up for a Fi Money account

3. Scroll down to the Spend Your Coins option and tap it.

4. There will be a new offer there – Play using Fi-Coins.

5. Convert your 500 Fi coins into cash up to Rs 1,000 by scrolling left to right.

6. To change it into money, you’ll need at least 500 Fi-coins. You can convert twice a day.

Is Fi a credit card?

Fi Money is a digital savings bank account backed by Federal Bank. It does not offer a credit card right now.

How do I convert my Fi coins to cash?

Fi Money gives Fi coins to businesses and third-party apps with every transaction. Fi coins can be used to claim third-party offers, vouchers, and more. But, Fi Money recently added a new tool that allows you to convert your Fi coins into cash.

- To begin, download or update your Fi money app on Android or iOS.

- Launch the app and sign up for a Fi Money account

- Scroll down to the Spend Your Coins option and tap it.

- There will be a new offer there – Play using Fi-Coins.

- Convert your 500 Fi coins into cash up to Rs 1,000 by scrolling left to right.

- To change it into money, you’ll need at least 500 Fi-coins. You can convert twice a day.

Is Fi a credit card?

Fi Money is a digital savings bank account backed by Federal Bank. It does not offer a credit card right now.