On this page Show

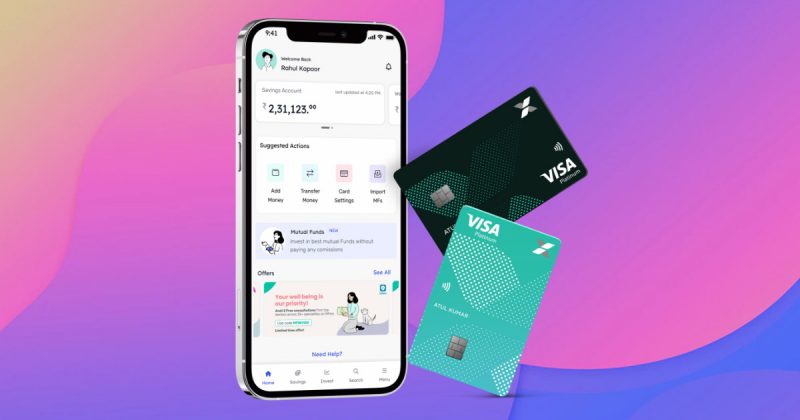

NiyoX is a neo banking platform that caters to the GenZ audience. NiyoX allows customers to instantly set up their bank account with a few clicks. The platform collaborates with Equitas Small Finance Bank, and therefore, when you sign up with NiyoX, your bank account will be linked to Equitas instantly. NiyoX serves as a two-in-one savings and wealth management account, providing youngsters with a new level of banking comfort.

Here is our review of NiyoX, where we delve deep into the pros, cons, rewards, cashback, and more. We attempt to answer the question of whether you should apply for the NiyoX savings account is for you or not? Here you can also check some of the best bank for salary account.

Fees and charges

| Processing fee | Nil |

| Insurance fee | Nil |

| Preclosure fee | Nil |

Pros & Cons

Interest rates and tenure

| Interest rate | Interest rate: <Rs 1 lakh – 3.5% >Rs 1 lakh – 7% |

| Tenure | N/A |

| Processing time | Instant |

Minimum and Maximum Amount

| Minimum | Rs 1 lakh |

| Maximum | Rs 50 Lakh and above |

Who Should use NiyoX Savings Account?

Neo-banks deliver a mobile-first, simple, and user-friendly banking experience that millennials and GenZ prefer. Customers who want a 100% digital process can go for NiyoX as it saves you from the hassle of physical visits to bank branches.

NiyoX also provides unique referral options through which you can get discounts and offers; The referrals program is a good route for you and your friends to earn some extra cash. Fund transfers and all transactions made with your debit card earn you points, which can be redeemed for products as well.

Eligibility Criteria

Age

- Applicant should be at least 18 years old

Location

- Indian Resident

Documents required

- Aadhaar card

- Bank Account Statement

- Passport size photograph

- KYC Address proof

Ratings and Reviews

- Eligibility 4/5 NiyoX streamlines clients’ banking demands and experiences by providing quick and seamless solutions. Customers must give a PAN card and an Aadhar card connected to their contact number. And, in less than one minute at the convenience of your home, a digital bank account can be set up with a few processes at your fingertips.

- Rewards 4/5 Customers can earn Equinox rewards points for purchases made with the debit card at the point of sale and on the internet transactions. Equinox reward points can be used to purchase products/ services and merchandise.

- Overall 4/5 Since its launch in March 2021, the NiyoX application has seen a massive increase in clients, with over 10 lakh active users. NiyoX now serves at 26000+ pin codes across India, intending to expand its services to the most remote parts of the country and underbanked communities.

Conclusion

The fundamental concept of NiyoX savings account is to give all consumers a safe and simple financial solutions platform. Neo banks run entirely online, eliminating the need for physical visits. The account holder’s transactions and account information are maintained secure and carried out safely within the application. You can also check about the best private bank of India.

FAQs

Is NiyoX RBI approved?

You can rest easy knowing that your NiyoX account is protected by the RBI’s insurance coverage of up to Rs. 5 lakh.

Is NiyoX a bank?

NiyoX is a digital banking app developed by an Indian neo-banking pioneer. Niyo collaborates with Equitas Small Finance Bank and VISA to help millennials understand banking better.

Is NiyoX RBI approved?

You can rest easy knowing that your NiyoX account is protected by the RBI’s insurance coverage of up to Rs. 5 lakh.

Is NiyoX a bank?

NiyoX is a digital banking app developed by an Indian neo-banking pioneer. Niyo collaborates with Equitas Small Finance Bank and VISA to help millennials understand banking better.

Is NiyoX a zero balance account?

You’ll get a Zero Balance Savings Account with no minimum balance requirement.

Is the NiyoX debit card lifetime free?

Yes, NiyoX zero balance saving account is free.

Is NiyoX reliable?

Neo-banking is a novel notion for many individuals, and as with everything new in banking, customers are worried about their safety and security. NiyoX has customers covered with all the safety and security and the account is insured for up to Rs. 5 lakhs.