On this page Show

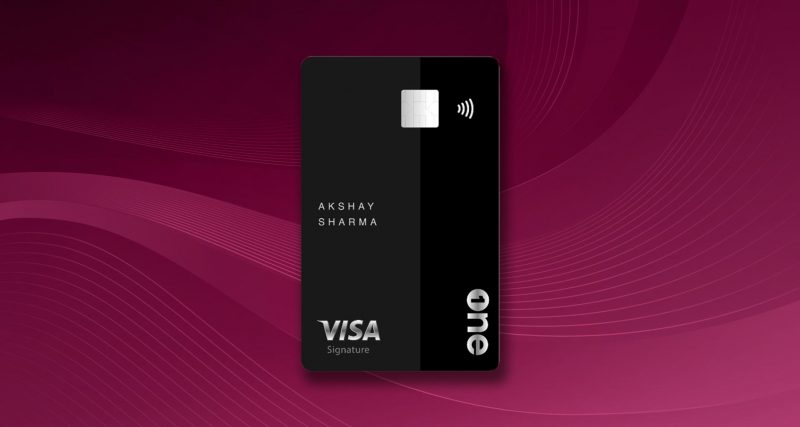

OneCard credit card is one of the only few entry-level credit cards that boast a metal form factor. It is a hyped card in that sense, but still, if you intend to show off the metal, it’s a satisfactory choice.

OneCard has everyone looking at it for being an entry-level card with zero joining cost and annual fees while being explicitly designed for beginners. This card can be an excellent choice for customers who want a card with no cost yet with a good app UI and decent rewards.

Read below to know more about the OneCard benefits and what you need to look out for a while buying this card. Readers are encouraged to read all the information below to decide if the OneCard metal credit card is worth it for you or not.

Fees and Charges

| Lable | Fees |

|---|---|

| Joining Fee | Nil |

| Annual Fee | Nil |

| Interest Rate | 2.5% |

| Forex Markup Fee | 1% + GST |

Pros & Cons

Rewards and Cashback

OneCard has a reward rate ranging from 0.2% to 1% for instant redemption for a statement credit.

Who Should Get a OneCard?

OneCard is a free metal credit card agreeably for individuals who are new to the credit world and like to accumulate reward points on their buys. OneCard gives credit cards most promising features as it comes with no joining and annual fees. It provides the customers a metal form factor and is excellent for the cashback/rewards. This card has a long-term significance, distinct from other credit cards in the Indian sector. Hence, cardholders can benefit from all the users without any costs. you may also like to read about uni card benefits

Eligibility Criteria For OneCard

1. Age

The age of the cardholder should be between 21-and 60 years.

2. Location

Indian Resident

3. Documents required

Customers can avail the benefits of the OneCard by submitting the following documents:

- Photocopy of Address proof, bank account Statement, Driving License, Aadhar Card, Utility bills, Passport

- 2 recent passport-sized photographs

- Photocopy of ID Proof

- ITR (Income Tax Return)

- Proof of income

Ratings and Reviews

- Cashback and Rewards 3/5: The OneCard entry-level credit card has fancy attributes, but the meagre reward rate of 0.2% on everyday spending makes it less appealing. But the card has a 5X on the top 2 categories, which is an good option if you can utilise it well. Plus, you get regular discounts on apps like Swiggy, 1mg, and more.

- Fees and charges 4.5/5: The OneCard has nil joining and annual fee involved making it appealing.

- Eligibility 4.5/5: The individual needs to have an adequate and steady income and needs to be 21 to 60 years.

- Overall 3.5/5: OneCard makes for one of the best Credit Cards in India for the first-time cardholders. Nevertheless, the rewards rate is slightly lower than other credit cards.

Conclusion

OneCard is a fantastic entry-level credit card. OneCard credit card is a solid choice as it is lifetime free. The card has a unique reward program and a low-interest rate. It is the only metal credit card that comes for free in India right now. This credit card will certainly provide good returns on transactions. However, if you are looking for a high reward rate and other luxury benefits, you should look elsewhere. If you like to read about this topic, may we also suggest our In-depth review of fampay card?

FAQs

Which bank is associated with OneCard?

OneCard was founded by FPL Technologies, and functions on the IDFC Bank and Federal Bank platforms via Visa (Signature) network.

What is the use of OneCard?

OneCard, in collaboration with several banks, offers various rewards and gives happiness with the metal card.

Who is the owner of OneCard?

Vibhav Hathi, Rupesh Kumar, and Anurag Sinha founded OneCard in 2019, which is offered by FPL Technologies.

Is OneCard a credit card or a credit line?

The OneCard is an entry-level metallic credit card.

How do I get a OneCard?

If you meet the eligibility criteria, then you can apply for the OneCard. The OneCard is a free metal Credit Card that has zero joining and annual fees. The OneCard has an elegant design and overall lower markup fees on Foreign Transactions of 1% compared to other Credit Cards in India.

The onboarding approach for this credit card is entirely digital with no physical verification and immaculately given on your CIBIL score.

What is the limit on the OneCard?

OneCard has credit limits ranging from thousands of rupees to lakhs of rupees. It depends on the user profile and credit score.

Is the OneCard registered by the RBI?

OneCard is issued in partnership with banks. The company has a tie-up and collaboration with other RBI-registered banks to issue their OneCard.