On this page Show

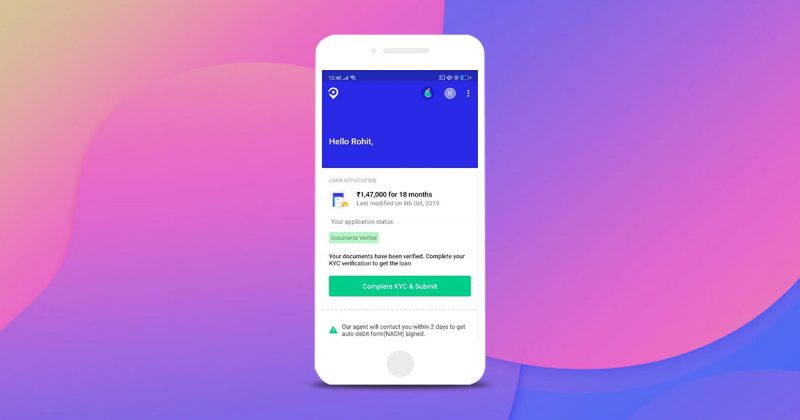

PaySense is a new-age BNPL app that offers quick loans ranging from Rs. 5000 to Rs. 5 lakh even to those with no previous credit history. The loan can be readily repaid with modest EMI plans. You get frequent reminders, payment notifications, and an easy-to-manage EMI schedule. The documentation can also be requested at home in a simple process that requires you to sign and deliver the necessary documents to the courier.

Here is our review of PaySense, where we delve deep into the pros, cons, rewards, benefits, and more. We attempt to answer the question of whether you should get one for yourself or not.

Three types of loans are available through PaySense:

Instant Personal Loan – This is available for salaried and self-employed individuals. The loan can be utilized for various personal requirements like higher education, medical, travel, and other personal expenses.

Vehicle Loan – Customers can get these loans to buy a brand-new car, a used car, or even a two-wheeler.

Consumer loan – This loan is aimed at assisting you in purchasing consumer durables.

You do not need to pay for the item in full or use your credit card to make these payments. Instead, you might take up a PaySense loan to convert these expenditures into manageable EMI payments.

PaySense Review 2022

Pros

- An instant personal loan from Rs. 5000 to Rs. 5 lakh

- Interest rates between 1.33% to 3% per month

- Repayment through simple EMI options ranging from 3 months to 5 years.

- PaySense provides its services in more than 180+ cities and 4000+ pin codes in India.

- After three successful EMI payments, you can repossess your loan with an extra fee of 4% on the outstanding principal.

- Quick loan approval and disbursal.

- Easy doorstep process of documentation.

- With the help of PaySense fast loans, you can buy phones, computers, cameras, and other consumer durables.

- PaySense has partnered with leading NBFCs: Credit Saison India, Fullerton, IIFL, PayUFinance, and IDFC First Bank for loan disbursal.

Cons

- Customers have complained about the floating rate of interest.

- Customers have complained about misinformed customer service and misbehaving agents.

Interest rates and tenure

- Interest rate – 1.33% p.m. to 3% p.m.

- Tenure – 3 months to 60 months

- Processing time – two business hours; within four days of receiving the application, the funds are disbursed.

Fees and charges

- Processing fee – 2% – 2.5% of the loan amount + GST or ₹500 + GST (depends on whichever is higher).

- Preclosure fee – 4% of the outstanding principal amount

Loan amount (minimum and maximum)

- Minimum amount: Rs 5,000

- Maximum amount: Rs 5,00,000

Who should use PaySense?

PaySense is an internet-based BNPL website and app that assists users seeking no-credit-check instant personal loans. Users who desire a loan in the range of Rs 5000 to 5 lakh with a simple and safe procedure with an option to avail guidance at their doorstep can go for PaySense loans. On Android and iOS phones, the app can be readily downloaded from the Google Play Store.

Eligibility criteria

Age

The applicant must be between 21 – 60 years.

Income

The income of a self-employed person should be at least Rs. 20,000, and the income of a salaried person should be at least Rs.18,000.

Location

Indian Resident only

Documents required

- PAN card

- Address proof (Aadhaar Card/ Voter ID/ Passport /Rent Agreement/ Electricity Bill/ Water Bill/ Landline Bill / Bank Statement/Passbook/ Gas Pipeline receipt)

- ID Proof (Aadhaar card)

- Photograph

- Bank account details

- Current Address Proof

Conclusion

PaySense is one of India’s premier loan providers, claiming to be 100% safe and secure. PaySense offers a variety of loans ranging from personal loans to vehicle loans to home renovations to consumer durables and more. The process is swift since PaySense begins verifying the application right away, and the money is disbursed within four days of receiving the application, processed in just two working hours.

Ratings and Reviews

Fees and charges – 3.5/5 PaySense claims that they have no hidden charges. All the charges such as interest rate, loan amount and processing fees, etc are communicated to customers at the processing time. However, some customers have expressed their dissatisfaction. PaySense charges Rs. 500 + GST on late payments and a 4% penalty on the principal left at the time of foreclosure.

Eligibility – 3.5/5 With PaySense, customers can apply for various loans. However, the loan amount should not exceed the total loan amount as per the credit limit. People with no credit history are also eligible for a loan at PaySense, which means somebody who has never previously taken out a loan or a credit card. The NBFC uses a paperless documentation process in which borrowers can upload their KYC documents and digitally sign their loan applications.

Overall – 4/5 In India, PaySense has a sizeable consumer base. There are more than 120,000 satisfied consumers. On Google Play, PaySense mobile app has a 4.3-star rating. PaySense has disbursed Rs 2000+ crore to date and a total of 200000+ loans. If you like to read about this topic, may we also suggest our list of the best private banks in India?

FAQs

Is it good to take a loan from PaySense?

While we cannot vouch for whether you should take a loan from PaySense or not, we know that the process is super simple. With only 3 simple steps, customers can get an instant loan of up to Rs. 5 lakh. PaySense is a good choice because it encrypts your important information and does not share it with third-party marketers.

What is the rate of interest in PaySense?

The rate of interest is 1.33% p.m. to 3% per month.

Is PaySense safe?

Yes, PaySense is largely safe in the BNPL space; it encrypts your personal and sensitive data; your data is kept from internal verification only, making your online experience secure and protected.

Can I foreclose my PaySense loan?

Yes, after paying three EMIs of your loan amount, if you might choose to foreclose on it. A 4% foreclosure charge is applied to the remaining principal amount at the time of foreclosure.