Showing 19 Credit cards

Start Saving on Fuel

Find the best fuel card to see how much you’ll save at every fill-up

Unlock Annual Savings

₹X,XXX

15 Fuel Points per ₹100 on IndianOil Fuel Spends on every ₹100 spent at IndianOil fuel stations, capped at 2,000 fuel points per month

1% Fuel Surcharge Waiver at IndianOil Pumps on fuel transactions, capped at ₹200 per month

Unlock Annual Savings

₹X,XXX

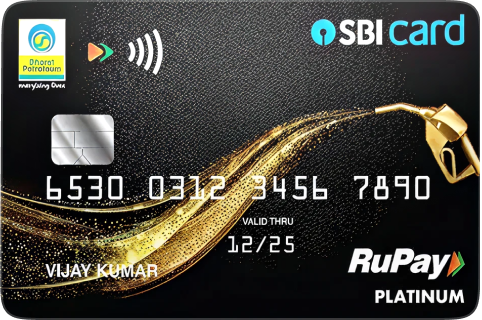

Earn 5% Rewards on HPCL Fuel through 30X Reward Points on fuel spends at authorised HPCL fuel stations

Up to 30X Reward Points on HPCL Fuel on spends up to ₹12,000 per statement cycle, helping you earn up to 2,400 reward points every month on fuel purchases

Unlock Annual Savings

₹X,XXX

1% Fuel surcharge waiver on transactions between ₹400 to ₹5000, with a maximum waiver of ₹400 per month

Unlock Annual Savings

₹X,XXX

1% Fuel-Surcharge Waiver on eligible transactions, subject to a maximum cap of ₹250 per statement cycle

Unlock Annual Savings

₹X,XXX

4% Accelerated Reward Points on fuel transactions at IndianOil outlets using your Axis Bank IndianOil Credit Card

Welcome bonus on first fuel transaction 1250 EDGE Reward Points on your first fuel transaction at an IndianOil outlet within 30 days of card issuance

Unlock Annual Savings

₹X,XXX

7.25% Value Back & 25X Reward Points on BPCL fuel spends capped at 2,500 reward points per billing cycle

Enjoy 1% fuel surcharge waiver on BPCL fuel transactions up to ₹4,000 per transaction, capped at ₹100 per statement cycle

Unlock Annual Savings

₹X,XXX

Earn 20 Reward Points for Every INR 100 Spent at IndianOil Fuel Outlets on transactions between INR 400 and INR 4,000, with eligible spends capped at INR 5,000 per calendar month

Unlock Annual Savings

₹X,XXX

Get 4% cashback (Max ₹200/Month) on fuel spends at HPCL pumps, plus 1% fuel surcharge waiver on transactions up to ₹4,000. Earn an additional 1.5% rewards on HP Pay transactions

Unlock Annual Savings

₹X,XXX

Fuel Points Worth ₹0.50 per Point at IndianOil when redeemed at IndianOil petrol pumps or against IndianOil fuel vouchers

1% Fuel Surcharge Waiver at IndianOil Pumps on fuel transactions between ₹500 and ₹4,000, capped at ₹100 per month

Unlock Annual Savings

₹X,XXX

Get 2,000 Activation Bonus Reward Points worth ₹500 credited within 20 days of joining fee payment, redeemable instantly at BPCL petrol pumps or via the Shop & Smile Rewards Catalogue

Earn 13X Reward Points on fuel purchases at BPCL petrol pumps, with a maximum of 1,300 Reward Points per billing cycle

Unlock Annual Savings

₹X,XXX

3.5% Savings on HPCL Fuel Spends get 21 reward points per ₹150 spent on HPCL fuel transactions, capped at 700 reward points per statement cycle

1.5% Savings via HP Pay App earn 6 Happy Coins per ₹100 spent on fuel through the HP Pay App, capped at 600 Happy Coins per month

Unlock Annual Savings

₹X,XXX

5% Fuel Points for every ₹100 spent at IndianOil Outlets

Unlock Annual Savings

₹X,XXX

1% Fuel Surcharge Waiver valid on fuel transactions between ₹500–₹4,000; surcharge is reversed in the next statement

Unlock Annual Savings

₹X,XXX

1% Fuel Surcharge Waiver Across India on fuel transactions between ₹400 and ₹5,000, capped at ₹250 per statement cycle

Unlock Annual Savings

₹X,XXX

1% Fuel Surcharge Waiver on HPCL Spends on fuel transactions between ₹400 and ₹4,000 at HPCL petrol pumps

Unlock Annual Savings

₹X,XXX

Save 4% as Reward Points on IndianOil Fuel Spends.Get 24 reward points on every ₹150 spent, capped at 1200 reward points per statement cycle

Earn Rewards Points such as 24 RP on IndianOil fuel (cap 1,200/stmt) per ₹150; 12 RP on dining & grocery (cap 800/stmt) per ₹150; 3 RP on other spends per ₹150

Unlock Annual Savings

₹X,XXX

1 % Fuel Surcharge Waiver on fuel transactions of ₹400–₹5 000 (max waiver ₹500 per statement cycle)

Unlock Annual Savings

₹X,XXX

1% Fuel Surcharge Waiver Valid on fuel transactions ₹400–₹4,000 across India

Unlock Annual Savings

₹X,XXX

1% Fuel Surcharge Waiver on fuel transactions of ₹400 and above, with a maximum waiver of ₹250 per statement cycle

Find the Best Fuel Credit Cards in India for 2026

In 2026, managing escalating fuel costs remains a significant concern for many commuters and households across India. Fuel credit cards offer a strategic solution, providing substantial savings through cashback, accelerated reward points, and essential waivers on fuel transactions. These specialised cards are designed not just to offset fuel expenses but also to integrate seamlessly into daily spending habits, offering value across various categories.

Why Fuel Credit Cards are Essential in 2026?

Fuel credit cards have evolved beyond simple discount tools. They are now sophisticated financial instruments that deliver significant value back on one of the most consistent monthly expenditures. By partnering with major fuel refineries like IndianOil, BPCL, and HPCL, leading banks such as SBI Card, Axis Bank, HDFC Bank, ICICI Bank, and RBL Bank offer tailored benefits that make every refill more rewarding. Cardholders can look forward to direct cashback or amplified reward points on fuel transactions, along with additional earning opportunities on groceries, utilities, and departmental store purchases, thereby enhancing overall saving potential for 2026.

Understanding the Value of Fuel Credit Cards

The perks associated with fuel credit cards extend far beyond merely purchasing petrol or diesel. These cards are crafted to embed savings into your routine, transforming everyday transactions into opportunities for greater financial advantage.

Maximising Savings on Fuel Expenses

- Cashback and Reward Points: A primary draw of these cards is the elevated cashback or reward points offered specifically on fuel transactions, often at co-branded partner outlets. Some cards even provide bonus points as loyalty rewards when using associated fuel apps or specific payment methods.

- Flexible Redemption Options: The reward points accumulated from fuel and other eligible spends can typically be redeemed in various ways. A highly sought-after option is converting points into future fuel purchases, effectively giving you free fuel. For instance, some cards allow you to earn up to 50 litres of free fuel annually by redeeming accrued points. Other redemption avenues include statement credit, e-gift vouchers, or selecting items from a curated rewards catalogue.

- Significant Fuel Surcharge Waivers: A fuel surcharge, typically around 1% to 2% of your transaction, is levied at petrol pumps. Most fuel credit cards offer a waiver on this charge, usually capped at a certain amount per month and applicable within specific transaction ranges. This seemingly small saving can add up considerably over the year, reducing the overall cost of your fuel.

Beyond Fuel: Additional Card Benefits

- Co-branded Advantages: A majority of fuel credit cards are co-branded, meaning they offer amplified benefits when used at their partnered fuel stations. If you consistently visit a particular brand's pump, selecting a card co-branded with that company will maximise your rewards in 2026.

- Complimentary Perks and Milestones: Many top fuel cards offer a suite of additional benefits, including exclusive memberships, bonus rewards upon reaching spending milestones, and discounts on other categories. These could range from complimentary lounge access at domestic airports to movie ticket discounts and accelerated earnings on dining, groceries, and utility bill payments.

- Attractive Welcome Offers: New cardholders in 2026 can often benefit from generous welcome bonuses, such as bonus reward points on their first transactions, cashback on initial fuel spends, or gift vouchers. These introductory offers provide immediate value and help offset any joining fees.

Top Fuel Credit Cards in India for 2026: A Detailed Review

Here's a comprehensive look at some of the best fuel credit cards available in India for 2026, highlighting their unique features, benefits, and ideal user profiles.

IndianOil RBL Bank XTRA Credit Card: Superior Savings for IOCL Users

The IndianOil RBL Bank XTRA Credit Card stands out for its exceptional value proposition for those loyal to IndianOil outlets. It boasts an impressive up to 8.5% value-back on IOCL fuel spends, making it one of the most rewarding options in this category for 2026. Cardholders earn 15 Fuel Points for every ₹100 spent at IOCL fuel stations, with a monthly cap of 2,000 Fuel Points. Additionally, it offers a 1% fuel surcharge waiver on transactions between ₹500 and ₹4,000, capped at ₹200 per month.

Beyond fuel, the card provides 2 Fuel Points for every ₹100 spent on other categories. New users receive a welcome benefit of 3,000 Fuel Points on their first transaction of at least ₹500 within 30 days of card issuance. An annual fee of ₹1,500 applies, which is waived upon achieving ₹2.75 lakh in annual spends. Fuel Points can be redeemed at a rate of 1 Fuel Point = ₹0.50 for IOCL fuel purchases, offering substantial savings for high-frequency commuters.

BPCL SBI Card Octane: Comprehensive Rewards for BPCL Spenders

For individuals who frequent BPCL fuel stations, the BPCL SBI Card Octane is a top-tier choice in 2026, offering a compelling 7.25% value-back on BPCL fuel expenses. This translates to 25 reward points for every ₹100 spent on BPCL fuel, lubricants, and Bharat Gas (via website and app). It also includes a 1% fuel surcharge waiver on BPCL fuel spends up to ₹4,000, with a monthly cap of ₹100.

What sets this card apart is its broad reward structure beyond fuel. Cardholders earn 10X reward points on dining, movies, groceries, and department store spends, up to 7,500 points per month, and 1 reward point per ₹100 on other retail purchases. A welcome bonus of 6,000 reward points (worth ₹1,500) is provided upon annual fee payment. The annual fee is ₹1,499, reversible on ₹2 lakh annual spends. Furthermore, it offers 4 complimentary domestic Visa lounge visits per year, making it an excellent all-rounder for everyday spending and travel.

HPCL IDFC FIRST Power+ Credit Card: Value-Back on HPCL Fuel & More

The HPCL IDFC FIRST Power+ Credit Card is an attractive option for HPCL loyalists in 2026, delivering up to 6.5% value-back on HPCL fuel spends. This includes 30 reward points for every ₹150 spent on HPCL fuel and LPG, along with 6 Happy Coins per ₹100 when paying through the HP Pay app. While it doesn't explicitly offer a fuel surcharge waiver, its high reward rates effectively compensate for it.

This card extends its benefits to other essential categories, offering 30 reward points per ₹150 spent on groceries, utilities, and IDFC FIRST FASTag, plus 3 reward points per ₹150 on UPI and other retail transactions. Welcome benefits include a ₹500 gift voucher on the first HPCL fuel transaction of ₹500 or more within 60 days of card setup, and 5% cashback (up to ₹1,000) on the first EMI conversion within 30 days. With an annual fee of ₹499 (waived on ₹1.5 lakh annual spends), it also provides 1 complimentary domestic airport lounge access per quarter (on minimum monthly spends of ₹20,000) and 25% off on movie tickets once a month, adding significant lifestyle value.

ICICI HPCL Super Saver Credit Card: Consistent Savings for HPCL Users

For those prioritizing cashback on HPCL fuel, the ICICI HPCL Super Saver Credit Card offers a respectable up to 6.5% savings in 2026. This is achieved through a 4% cashback on HPCL fuel spends (capped at ₹200 per month) and an additional 1.5% savings as 6 reward points for every ₹100 spent via the HP Pay app. Uniquely, it offers a 1% fuel surcharge waiver applicable on all fuel spends up to ₹4,000, not just at partner outlets.

The card also rewards daily necessities, providing 5% back as reward points (up to 400 points per month) on grocery, departmental store, and utility bill spends. Other retail purchases earn 2 reward points per ₹100. New cardholders receive 2,000 bonus reward points on spending ₹5,000 within 45 days. The annual fee is ₹500, waived on ₹1.5 lakh annual spends. Additional perks include 1 complimentary domestic airport lounge access per quarter (on spending ₹35,000 in the previous quarter) and 25% off on movie tickets twice a month.

IndianOil Axis Bank Credit Card: Rewarding IOCL Fuel Purchases

The IndianOil Axis Bank Credit Card is a solid option for individuals who prefer IndianOil outlets in 2026. It offers up to 5% value-back on IOCL fuel spends, primarily through 4% back as 20 EDGE reward points for every ₹100 spent on fuel purchases between ₹400 and ₹4,000 (capped at 1,000 points per month). It also includes a 1% fuel surcharge waiver, up to ₹50 per month, on fuel spends in the same transaction range.

Beyond fuel, the card provides 1% back as 5 EDGE reward points for every ₹100 spent on online shopping (up to ₹5,000, capped at 250 points per month), and 1 EDGE reward point per ₹100 on other spends. A welcome bonus gives 100% cashback, up to ₹250, on the first fuel spend within 30 days. The annual fee is ₹500, waived on ₹3.5 lakh annual spends. Cardholders also enjoy up to 15% off on dining via EazyDiner, adding value to lifestyle expenditures.

IndianOil Kotak Credit Card: Smart Savings on IOCL & Daily Spends

The IndianOil Kotak Credit Card is a budget-friendly option for IndianOil users in 2026, featuring a low annual fee of ₹449, which is easily waived on ₹50,000 annual spends. It offers up to 5% savings on IOCL fuel, translating to 4% back as 24 reward points for every ₹150 spent on IndianOil fuel (capped at 1,200 points per month). A 1% fuel surcharge waiver is provided, up to ₹100 per month, on IOCL fuel spends between ₹100 and ₹5,000.

This card also provides accelerated earnings on everyday categories, giving 2% back as 12 reward points per ₹150 on dining and grocery spends (up to 800 points per month). Other categories, including UPI transactions, earn 0.5% back as 3 reward points per ₹150. New users receive 1,000 reward points on making a minimum spend of ₹500 in the first month. With its accessible fee waiver and broad earning potential, it’s a practical choice for moderate spenders.

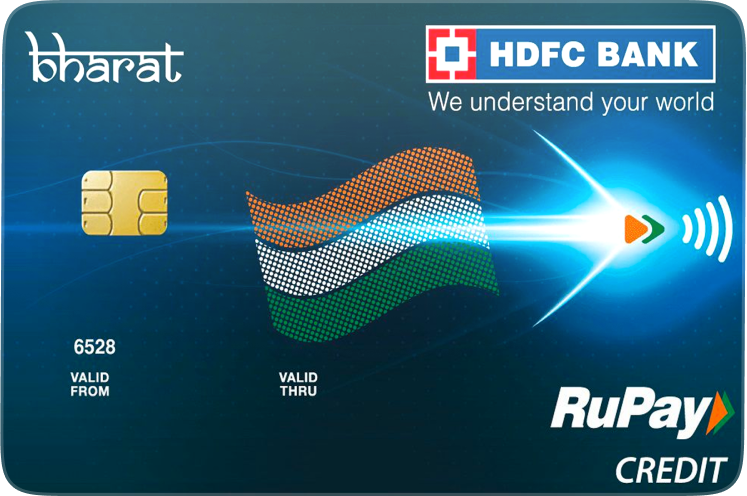

IndianOil HDFC Bank Credit Card: Free Fuel Potential with IOCL

The IndianOil HDFC Bank Credit Card is designed to help IndianOil customers earn significant savings in 2026, claiming to offer up to 50 litres of free fuel annually. It provides up to 6% savings, with 5% Fuel Points on spends at IndianOil outlets, groceries, and bill payments. Fuel Points earned on IndianOil outlets are capped at 250 points for the first six months, then 150 points thereafter. A welcome benefit includes a complimentary membership to the IndianOil XTRAREWARDS Program (IXRP).

The card also offers a generous 1% fuel surcharge waiver, up to ₹250 per month, for IOCL fuel spends of ₹400 and above. Other purchases, including UPI, earn 1 Fuel Point per ₹150. The annual fee is ₹500, waived on ₹50,000 annual spends. The value of Fuel Points is high when converted to XtraRewards Points (XRP), where 1 Fuel Point can equal up to ₹0.96 for XRP conversion, making its free fuel potential quite attractive.

ICICI Bank HPCL Coral Credit Card: Entry-Level Savings for HPCL

For those seeking a low annual fee option for HPCL fuel savings in 2026, the ICICI Bank HPCL Coral Credit Card is a strong contender. With a minimal joining and annual fee of just ₹199 (reversed on ₹50,000 annual spends), it offers up to 3.5% savings on HPCL fuel. This includes 2.5% cashback (up to ₹100 per month) on HPCL fuel spends of ₹500 and above, along with a 1% surcharge waiver on HPCL fuel spends up to ₹4,000 per transaction.

Beyond fuel, cardholders earn 2 ICICI Bank reward points per ₹100 on most retail spends (excluding fuel) and 1 reward point per ₹100 on categories like grocery, utility, and departmental stores. Additional benefits include 25% off on movie tickets via BookMyShow and 15% off on dining through the ICICI Bank Culinary Treats program. Its low cost and easy waiver make it an excellent choice for beginners or those with moderate fuel expenses looking for foundational savings.

Choosing Your Ideal Fuel Credit Card: Key Considerations for 2026

Selecting the best fuel credit card in 2026 requires a careful evaluation of your personal spending habits and preferences. Here are the essential factors to consider to ensure you pick a card that maximizes your savings.

Aligning with Your Preferred Fuel Brand

The most crucial factor is identifying which fuel stations you frequent the most. Since most fuel credit cards are co-branded (e.g., with IndianOil, BPCL, or HPCL), they offer significantly higher benefits at their partnered outlets. If you are loyal to a specific brand, opt for a card that rewards purchases at those pumps. Conversely, if you use various brands, a card offering benefits across all stations, or one with a very high general reward rate, might be more suitable.

Evaluating Reward Structures and Cashback Potential

Consider whether you prefer direct cashback or reward points. Some cards offer straightforward cashback on fuel transactions, while others provide reward points that can be redeemed for fuel, statement credit, or other items. Understand the value of these points upon redemption (e.g., 1 reward point = ₹0.25 vs. ₹0.50) and any caps on monthly earnings. A higher value-back rate on your primary fuel brand will yield greater savings over time.

Understanding Fuel Surcharge Waivers

While most fuel cards offer a 1% fuel surcharge waiver, the terms can vary. Pay attention to the minimum and maximum transaction limits for the waiver to apply, as well as the monthly capping on the waived amount. A card with a higher monthly waiver cap can significantly reduce your annual fuel costs.

Assessing Additional Lifestyle Perks

Beyond fuel, evaluate what other benefits the card offers that align with your lifestyle. Do you frequently dine out, watch movies, or use domestic airport lounges? Cards like the BPCL SBI Card Octane offer extensive rewards on dining, groceries, and movies, along with lounge access. Consider if these additional perks add enough value to justify the card's annual fee and make it a truly versatile tool for your spending in 2026.

Considering Fees and Eligibility in 2026

Review the joining and annual fees, and critically examine the conditions for fee waivers. Many cards waive the annual fee upon reaching a certain annual spending milestone, which can make a fee-charging card effectively free if you meet the threshold. Additionally, check the eligibility criteria, including age, income requirements, and credit score recommendations, before applying to ensure a smooth application process in 2026.

Comparing Top Fuel Credit Cards for 2026: A Quick Overview

To facilitate an informed decision, the table below offers a snapshot of key features, savings rates, and fees for some of the leading fuel credit cards available in India for 2026. This comparative data can help you quickly assess which card aligns best with your fuel consumption patterns and spending habits.

| Credit Card | Primary Fuel Partner | Joining Fee | Annual Fee (2026) | Fuel Savings Rate (Up to) | Fuel Surcharge Waiver | Annual Fee Waiver Condition |

|---|---|---|---|---|---|---|

| IndianOil RBL Bank XTRA Credit Card | IndianOil | ₹1,500 | ₹1,500 | 8.50% | 1% (up to ₹200/month on ₹500-₹4,000 spends) | ₹2.75 lakh annual spends |

| BPCL SBI Card Octane | BPCL | ₹1,499 | ₹1,499 | 7.25% | 1% (up to ₹100/month on up to ₹4,000 spends) | ₹2 lakh annual spends |

| HPCL IDFC FIRST Power+ Credit Card | HPCL | ₹499 | ₹499 | 6.50% | Not explicitly offered (high rewards compensate) | ₹1.5 lakh annual spends |

| ICICI HPCL Super Saver Credit Card | HPCL | ₹500 | ₹500 | 6.50% | 1% (all fuel spends up to ₹4,000) | ₹1.5 lakh annual spends |

| IndianOil Axis Bank Credit Card | IndianOil | ₹500 | ₹500 | 5.00% | 1% (up to ₹50/month on ₹400-₹4,000 spends) | ₹3.5 lakh annual spends |

| IndianOil Kotak Credit Card | IndianOil | ₹449 | ₹449 | 5.00% | 1% (up to ₹100/month on ₹100-₹5,000 spends) | ₹50,000 annual spends |

| IndianOil HDFC Bank Credit Card | IndianOil | ₹500 | ₹500 | 6.00% | 1% (up to ₹250/month on ₹400+ spends) | ₹50,000 annual spends |

| ICICI Bank HPCL Coral Credit Card | HPCL | ₹199 | ₹199 | 3.50% | 1% (on HPCL fuel up to ₹4,000 per transaction) | ₹50,000 annual spends |

Card Eligibility

Enter your details and get personalised card recommendations