On this page Show

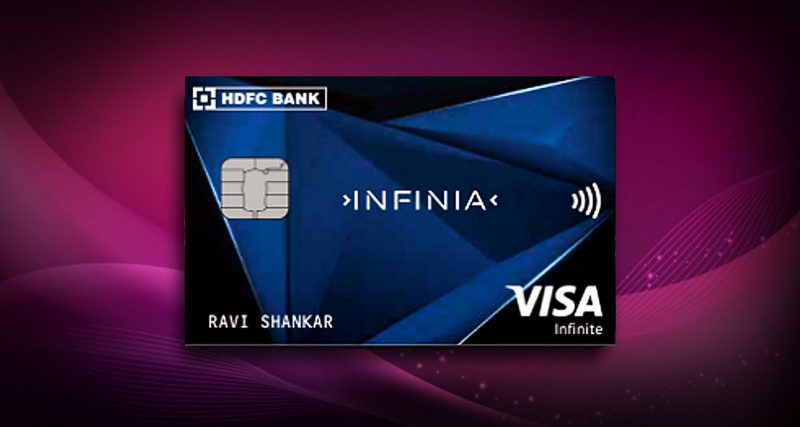

HDFC Bank Infinia is a high-end credit card that was introduced back in July 2011 and has had a few alterations since then. The card is based on reward points, and you may earn them for things like paying rent, buying insurance, and going to school. It gives frequent flyers and golf fans unrestricted access to golf and airport lounges.

You can set your own HDFC Bank Infinia credit card limit, and HDFC will gladly extend it. HDFC Bank Infinia has one of the best rewards programs, as evidenced by the fact that it offers 5 reward points for every Rs. 150 spent. Here is our review of the HDFC Bank Infinia credit card, where we delve deep into the pros, cons, rewards, cashback, and more. We attempt to answer the question of whether you should get one for yourself or not?

Fees and Charges

1. Metal Edition of INFINIA

The fee for joining or renewing membership is Rs. 12,500 plus applicable taxes. When you pay your charge and activate your card, you’ll get 12,500 reward points as a welcome and renewal bonus. Spend at least 10 lakhs in the previous 12 months and the renewal membership charge is waived for the next year.

2. For Infinia cards purchased before October 18th, 2021.

The fee for joining or renewing membership is Rs. 10,000 plus applicable taxes. When you pay your charge and activate your card, you’ll get 10,000 reward points as a welcome and renewal bonus. Spend at least Rs. 8 lakh in the previous 12 months and the renewal membership cost is waived for the next year.

- Renewal cost waived based on previous year’s spending of Rs. 8 lakh.

- The fee for the redemption of rewards is nil.

- 2 percent foreign currency markup (plus applicable taxes)

- Monthly Interest Rates: 1.99 percent (or 23.8 percent annually)

- A fuel surcharge of 1% is waived (capped at Rs. 1,000 per month)

Pros & Cons

Rewards and cashback

- Except for wallet loads and fuel, every Rs. 150 spent on anything earns you 5 reward points.

- Not only that, but you can save 2X if you spend on dining and shopping on the Air Vistara / HDFC Bank Infinia website. For every 1 lakh spent, that’s Rs. 6,600 worth in points!

- You can get up to 33 percent back in reward points on spending on travel bookings via the HDFC Bank Smartbuy portal.

- By converting your reward points into Air Miles, you can make the most of your points if you use particular airlines. These air miles can be redeemed for tickets and services on major domestic and international airlines.

Who Should Get an HDFC Bank Infinia Credit Card?

It should be noted that HDFC Bank Infinia is a credit card that is exclusively available to those who have been invited by the bank. This means that you may be eligible for this credit card only based on your previous credit history, as well as other factors considered by the bank.

HDFC Bank Infinia is a high-end credit card with a long list of benefits. Its initial and annual fees are both on the higher end of the scale. Premium perks like additional reward points, unlimited lounge access, a 3.3 percent default reward rate, and more will offset these numbers if your spending is high and smart.

If you are offered this credit card, you should take advantage of it. This card would swiftly pay you back, many times over, the annual fee you paid.

Usually, several HDFC Bank customers with an HDFC Bank Regalia credit card usually get an upgrade to Infinia after several years of high spending.

Credit Protection – for Rs 9 Lakhs (in case of accidental death and permanent disability)

Accidental fatality (by air): 3 million dollars (approx. Rs 22.5 crores)

Medical emergency coverage: Up to Rs 50 lakh in case of medical crises when traveling outside of India.

As a result, you won’t need to purchase supplementary travel insurance when traveling abroad because Infinia will cover all your needs. Apart from that, you can withdraw cash up to 40 percent of your credit limit without incurring cash withdrawal fees; nevertheless, interest will be charged.

Eligibility Criteria

This card is, in fact, a super-premium credit card. The eligibility requirements for this card are equally stringent. Interested customers must visit their nearest HDFC Bank branch and speak with the relationship manager.

Before applying for the HDFC Bank Infinia Credit Card, keep the following considerations in mind. HDFC Bank wants the cardholder to be a high-income earner because this is an out-and-out premium credit card.

- It is not necessary to have a domicile in India; nonetheless, being an NRI will suffice.

- Your CIBIL report will be beneficial if you have an excellent credit score.

- You must have all of the bank’s needed documentation.

Rating & Reviews

Source: HDFC Bank

Without a doubt, the HDFC Bank Infinia Credit Card is one of the best credit cards available in India. The 10X program’s payout rate of 33 percent is incredible. Unlimited lounge access globally, global golf privileges, and a dedicated support line to speak with a human are the icing on the cake. If HDFC Bank sends you an invitation for this card, accept it without hesitation. This card will quickly repay you, many times the annual premium levied.

Overall rating – 4.5/5

Conclusion

Customers with the HDFC Bank Infinia credit card can enjoy a variety of benefits, including 24-hour concierge service, complimentary access to the country’s top golf destinations, dining and travel benefits such as Priority Pass membership, unlimited complimentary lounge access all over the world, flight/hotel bookings using Reward Points, and, of course, a reward benefit of 5 Reward Points per Rs 150 spent with the card.

With all of these rewards and privileges, it’s easy to conclude that this card caters to practically every type of consumer. Of course, because this is a super premium credit card, your net worth must be very high to be eligible for this card, even if the bank does not state this expressly in their terms and conditions. You can complement it with an HDFC Bank Indian Oil credit card (review).

FAQs

Is HDFC Infinia card lifetime free?

HDFC Infinia is lifetime free no more. The new metal HDFC Bank Infinia has an annual fee of Rs 12,000 + GST.

How can I get an HDFC Infinia card invite?

To get an HDFC Infinia card invite, you need to have an annual salary of several lakhs, annual turnover of several lakhs, or a long-standing banking relationship with HDFC Bank with savings/ current/ fixed account holdings well over Rs 10-15 lakhs.

You can contact your HDFC Bank relationship manager to procure an Infinia card invite. Becoming an HDFC Bank Imperia customer also helps in scoring one.

What is the maximum limit of the HDFC Infinia credit card?

While the maximum limit on your HDFC Infinia credit card can go well beyond Rs 25 lakhs, the base monthly limit is usually Rs 8-10 lakhs.

How can I redeem my HDFC Infinia reward points?

To redeem your HDFC Infinia reward points, you can visit the SmartBuy Infinia portal.

- Login using your account details

- Choose from air tickets, hotel bookings, instant vouchers, and more

- Redeem your points by converting into an e-voucher