On this page Show

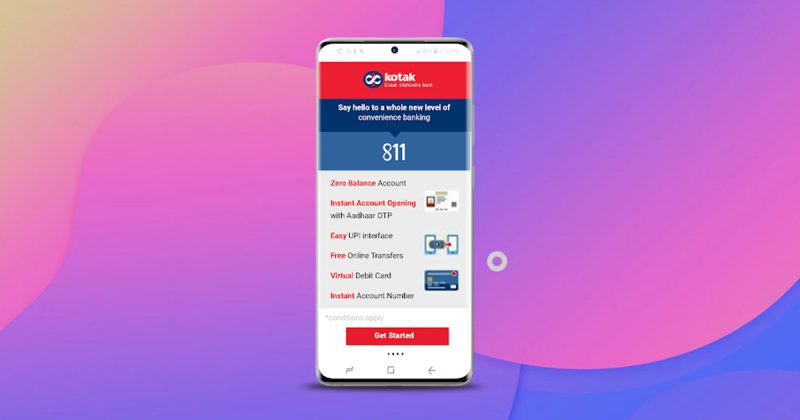

The Kotak 811 zero balance savings account from Kotak Mahindra Bank is a new-age savings account that comes in four variations: Kotak 811 Lite, Kotak 811 Limited KYC, Kotak 811 Full KYC, and Kotak 811 Edge. The account can be activated in as little as 5 minutes, and the interest rate offered is up to 3.5% per annum. For users of Kotak 811 edge account holders, this variant requires a minimum balance of Rs. 10,000 per month.

Here is our review of the Kotak 811 Savings account, where we delve deep into the pros, cons, rewards, fees, and more. We attempt to answer the question of whether this is the right savings account for you or not.

Kotak 811 Savings Account Review 2022

Types of Kotak 811 Savings Accounts

Kotak 811 Lite account

This is the simplest one in Kotak’s digital savings account suite; the account can be activated through the app or website with a relatively brief KYC process and basic identity proof like a PAN card. The average minimum balance (AMB) for this account is zero.

The physical or virtual debit card, online transactions, and cheques are not applicable for Kotak 811 Lite. The cumulative credits allowed are Rs 5,000 in a calendar month & Rs. 1,20,000 in a fiscal year. This account is valid for 12 months post-activation; the user will be asked to complete the KYC process to continue further.

No interest is provided on maintaining this savings account. The deposits can only be made through cash; however, no cash or cheque can be utilised to withdraw. The account functioning is only through Mobile/website.

Kotak 811 Limited KYC account

This variant is again a part of Kotak’s digital savings account. ABM for this account is zero; however a physical debit card is available here with a charge of Rs. 199 per annum, but the virtual debit card is free. The cumulative credits allowed are Rs. 2,00,000 in an FY. On the online transactions, IMPS & NEFT are free.

Similar to Kotak 811 Lite, the validity of the account is for 12 months; after that, KYC would be requested. The interest rate is about 3.50% on this savings account. Unlike Kotak 811 Lite, the users can deposit using cash and cheque but cannot withdraw with either of the options. The account Maintenance can be done only through Mobile/ website.

Kotak 811 Full KYC account

As the name implies, this account needs a complete KYC process while activation, including a FATCA declaration and document submissions. AMB is zero. For a physical debit card Rs. 199 p.a charge is to be paid, and the virtual debit card is free.

There are no restrictions on the cumulative credits, unlike the other two variants in this category. Besides IMPS & NEFT, RTGS is also free for online transactions with Kotak 811 Full KYC. Interest rate – 3.50%.

There is no limited validity period after account activation; cheques can be available on request. Other benefits include- deposits and withdrawal by cash and cheque. This account can be managed through mobile/ website plus Kotak’s physical branches.

Kotak 811 EDGE account

This Variant is not a part of the Kotak digital account; Kotak 811 EDGE requires an average minimum balance of Rs. 10,000. The physical Platinum debit card has a fee of Rs. 199 P.a, virtual debit cards are not available.

There are no restrictions for cumulative credits; IMPS & NEFT and RTGS are free for online transactions like Kotak 811 Full KYC account. The interest rate is 3.50%, and cheques are a default feature with this variant (which is missing in Kotak 811 lite and Kotak 811 limited KYC, However, with Kotak 811 Full KYC, it can be requested).

This is a long-term account, and cash withdrawal and cash deposit can be made through cash and cheque like Kotak Full KYC. This can be an option for users looking for a regular Kotak 811 Edge savings account and who want to use all the facilities like a chequebook, RTGS, and ATM facilities. This account can be managed through mobile and Kotak’s physical branches.

Pros

- Kotak 811 saving account offers unlimited account validity, unrestricted deposits and spends, and complete KYC verification at your doorstep.

- Users are offered free virtual debit cards for online transactions.

- Safe and sound online money transfer at zero cost through Kotak 811 digital savings account.

- The Kotak 811 application is protected with two-factor authentication; for the best and easy-to-use interface, users can access more than 180+ features with just one click for paying bills, shopping, investing, and even making bank transactions.

- No paperwork, No joining or annual fee

- Customers get 2X reward points on each online spend.

- The interest rate of 3.50% per annum on account balance

- Every month, users are granted up to five free ATM withdrawals.

Cons

- A joint Kotak 811 account is not possible.

- The basic account has extremely limited accessibility in times of fraud, complaints.

Rewards and cashback

- You can get 50% off your first Swiggy order with a Kotak 811 account. A maximum discount of Rs.125 is available.

- With a minimum purchase of Rs.2,000 and a Kotak 811 A/c, get a flat 10% discount on Titan.

- With a minimum purchase of Rs. 2,000 and a Kotak A/c, get a flat 10% discount on Tanishq.

- On a minimum purchase of Rs.2,995, get Rs. 600 off on Chumbak when you use your Kotak A/c.

- With a minimum spend of Rs.150 and a Kotak account, get Rs.75 discount on Zoom in.

- With a minimum purchase of Rs.900 and a Kotak A/c, get a flat 15% discount on Purplle.

- On a minimum purchase of Rs 1,190, get Rs.250 off on AJIO with a Kotak account.

- With a Kotak A/c, you can get a flat 30% discount for new customers and a 22% discount for existing users on Pharmeasy.

- Get a flat 20% discount on Behrouz Briyani when you pay with a Kotak A/c on a minimum purchase of Rs.349.

Fees and charges

- Joining Fee: Nil

- Annual Fee: Nil

- Interest rate: up to 3.5% per annum

- Debit card annual fees: Rs. 199 (for Kotak 811 Limited KYC, Kotak 811 Lite, and Kotak 811 full KYC), Rs 150 (for Kotak 811 Edge)

Who should get a Kotak 811 Savings Account?

Kotak 811 savings account is for a wide variety of individuals as it is a zero balance savings account and has a totally online process. The documentation process is easy; the KYC process is done through video mode and the account functions in just a few hours. It saves you from the hassle of doing physical labor, and it is a fit for students, homemakers, and self-employed people. However, avoid it if you want an extensive banking customer experience. If you like to read about this topic, may we also suggest our list of the best banks to open savings accounts in India?

Eligibility Criteria

Age

18+

Location

- Resident of India

Documents required

- PAN Card (Mandatory)

- Aadhaar Card

Conclusion

Kotak 811 is one of the most well-known digital accounts in India; it is an incredible go-to solution for avoiding physical fuss, and saving time, and is far superior to traditional bank account setup. Opening a Kotak 811 savings account takes less than 20 minutes and is simple. Customers receive an instant virtual debit card, and they can also make instant online transactions and transfers.

Ratings and Reviews

Cashback and Rewards: 3.5/5 The Kotak mobile app allows users to visit Kaymall (Kotak’s online shopping portal). Kaymall has several offerings for various websites such as Flipkart, Goibibo, IRCTC, etc.

Security – 4/5 To prevent unauthorised access to your banking information, Kotak 811 utilises security measures such as firewalls and internal system encryption. Users can open their preferred Kotak 811 bank account on the Kotak website in under 20 minutes and use their virtual debit card as soon as the account is available to use. Plus, it’s quite an experience to open an account from the comfort of your own home.

Minimum Balance – 4/5 Kotak is one of the few banks that provide the ease of “ No minimum balance requirement” however, to this feature, Kotak 811 Edge account is an exception because it requires a monthly minimum balance of 10,000 rupees.

Overall – 4.5/5 With the convenience of a zero balance account and the ability to choose from four different kinds of Kotak 811 accounts, Kotak 811 can be a fit for most customers. Users can skip going to the bank and doing the formalities because, with Kotak, the process is online and simplified in many ways. However, when it boils down to picking from the 4 variations, it can depend on the user’s personal needs.

FAQs

Is Kotak 811 a good account?

Yes, Kotak 811 is a good account as there are no penalties with Kotak 811 accounts, and you can use your money to its maximum potential. However, Kotak 811 Edge is a standard savings account that requires an average monthly balance of Rs. 10,000. (AMB).

What is the use of Kotak 811?

Kotak 811 provides you with a Virtual Debit Card within your Mobile Banking App. You can use it to shop online, pay bills, recharge, or pay at merchant outlets using ‘Scan & Pay.’ Customers who have validated their details using Aadhaar OTP are given this Debit Card.

What is the difference between Kotak 811 and a normal account?

Regular Savings Accounts have existed for quite some time. The modern incarnation of a savings account is the digital savings account, such as Kotak 811. There are distinctions between digital savings accounts such as Kotak 811 and traditional savings accounts like a totally online process, precise documentation process, zero minimum balance requirements, virtual debit card, various options of accounts as per need, and video KYC facility.

What is the maximum limit of the Kotak 811 account?

The maximum amount you can store in this account at any given time is Rs. 10,000. Unless the in-person full KYC process is completed, the account will be active for 12 months, and the total of all credits in the account in a financial year should not exceed Rs. 1,20,000/-.