On this page Show

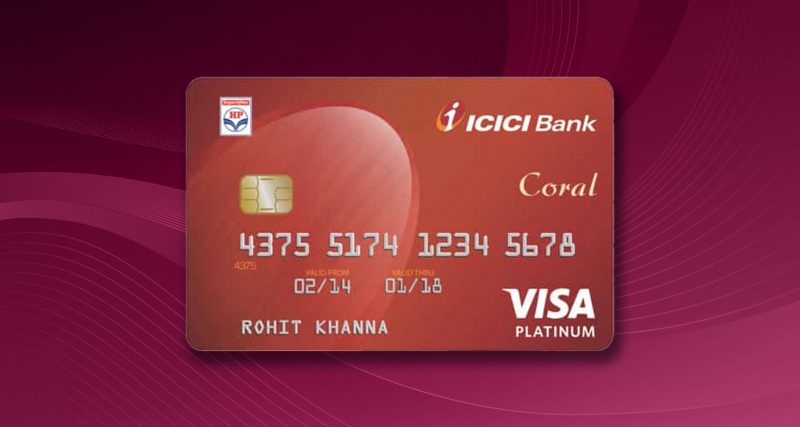

The ICICI Bank HPCL Coral Credit Card was introduced in collaboration with Hindustan Petroleum, one of the largest oil and gas retail chains in India. The card allows you to get up to 2.5% back & an additional 1% surcharge waiver on fuel transactions at HPCL. You can avail of PAYBACK points on other eligible purchases as well.

Apart from reward points, the card offers unique dining discounts through the ICICI Bank Culinary Treats Programme and a 25% movie discount on BookMyShow. Here is our review of the ICICI Bank HPCL Coral Credit Card Review, where we delve deep into the pros, cons, rewards, cashback, and more. We attempt to answer the question of whether you should get one for yourself or not?

Fees and Charges

| Lable | Fees |

|---|---|

| Joining Fee | Rs. 199 + GST |

| Annual Fee | Rs. 199 + GST |

| Interest rate | Rs. 3.4% per month (40.8% per annum) |

Pros & Cons

Rewards and Cashback

- When the card is swiped at ICICI Merchant Services machines, you can get up to Rs 100 cashback on fuel purchases at HPCL pumps month after month, year after year. 2.5% cashback on fuel purchases at HPCL fuel pumps is applicable on a minimum transaction value of Rs 500.

- When the card is swiped on ICICI Merchant Services swipe machines, a 1% fuel surcharge will not be applied to fuel transactions of up to Rs 4,000 at HPCL pumps.

- If you spend Rs 50,000 or more on your every year, ICICI will waive your annual fee (of Rs 199). All eligible transactions in an anniversary year will be counted; however, any fees or charges will be excluded. To be eligible for this offer, the card must not be cancelled or have late payments.

Who Should Get an ICICI Bank HPCL, Coral Credit Card?

This card’s renewal cost is waived if you spend Rs 50,000 in a billing year, which is a great benefit to have especially if you are a low spender and use this card just for fuel spending.

With all these unique benefits, the ICICI Bank HPCL Coral Credit Card is an excellent choice for anyone seeking a card with a low joining/renewal cost and a lot of savings potential on your fuel top-ups for office and leisure commutes. If you want slightly more value for your spending, you can check out the ICICI Bank HPCL Super Saver credit card (review). For a super premium credit card by ICICI Bank, you can also look at the ICICI Bank Emeralde (review).

Eligibility Criteria

1. Age

Applicants must be between the ages of 18 and 60 years old.

2. Location

The applicant should be an Indian National

3. Income

The applicant should have a steady source of income to keep up with the repayment procedure. You should also have a decent credit score and no credit defaults on record.

4. Documents

- Proof of Identity

- Proof of Address

- PAN Card

- ITR or salary slips for the last 2-3 months

- Passport-sized photographs

Ratings and Reviews

Source: ICICI Bank.

- Cashback and Rewards 3.5/5 A few users have recently mentioned that their points/cashback are not being processed as quickly as they used to, and part of the reason for this is that ICICI now requires you to swipe only on ICICI swipe terminals.

- Fees and charges 4.5/5 The fees and charges are negligible; the exemption of the renewal cost also appears to be a fantastic deal for a beginner who may be using this card.

- Eligibility 4.5/5 Before submitting your application, you only need to provide a few personal and professional facts. You can also apply for a card at your local bank location. Hence the Eligibility and assistance for the same are quite promising.

- Overall 4/5- ICICI Bank is one of India’s most reputable banks, having a large client base and a long list of satisfied customers. The HPCL Coral card is a no-brainer if you have a decent amount of fuel spent in a year. It’s free money for a super low annual fee, which is exempt with a spend threshold of just Rs 50,000 in a year. ICICI Bank is regarded as being extremely customer-centric and committed to giving nothing but the best to its clients.

Conclusion

The ICICI Bank HPCL Coral Credit Card is one of the best fuel credit cards in the Indian market. The card not only offers you access to PAYBACK rewards but also allows you to redeem your earned points with the flexibility of where you want to redeem them. This card comes with additional discounts on fuel purchases at HPCL pumps as a result of the relationship, which can help you save a lot of money on fuel top-ups. This card offers its customers benefits in a variety of categories, including dining, entertainment, and more, for a low joining/renewal fee.

FAQs

What is the ICICI Bank HPCL Coral credit card?

ICICI Bank HPCL Coral Credit Card was introduced in collaboration with Hindustan Petroleum. The card allows you to get up to 2.5% cashback & 1% surcharge waiver on fuel purchases at HPCL

Is ICICI Bank HPCL Coral a good card?

With a considerably low annual fee and good returns, yes, ICICI Bank HPCL is a good card for your fuel spending.

How much can I save via ICICI Bank HPCL Coral credit cards?

The card helps you save up to 2.5% on fuel expenses and also rewards you with PAYBACK points on retail purchases.

What is the Processing time for the ICICI Bank HPCL Coral Credit Card?

It may take up to 20-21 days or even more to process your ICICI Bank HPCL Coral credit card application.

How can I know my ICICI bank HPCL Coral Credit Card due date?

Customers can check the due date from your last statement on the bank’s website and get to know your dues along with the due date.