On this page Show

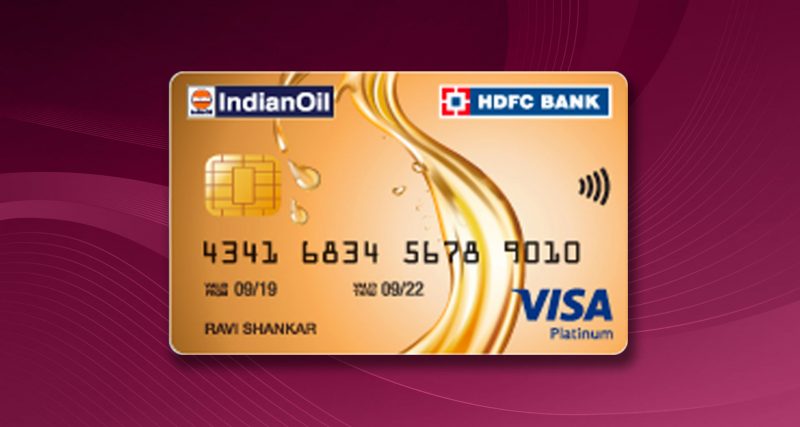

HDFC Bank and the Indian Oil Corporation have collaborated to create the Indian Oil HDFC Bank card. This credit card is designed specifically for people who frequently travel around the city in their own vehicles. The card has a lot of functions and perks, especially when it comes to fuel and other things. Here you can also check, hdfc bank diners club black credit card & hdfc millennia credit card review.

The HDFC Bank Indian Oil Credit Card comes with a number of features that might assist you in earning valuable reward points. You can then use those points to get cashback on refueling and grocery shopping in the future. Here is our review of the HDFC Bank Indian Oil Credit Card Review where we delve deep into the pros, cons, rewards, cashback, and more. We attempt to answer the question of whether you should get one for yourself or not?

Fees and Charges

| Lable | Fees |

|---|---|

| Joining Fees | Rs 500 + GST |

| Annual Fees | Rs 500 + GST (waived off on spe |

| Interest rate | 3.49% per month |

Pros & Cons

Rewards and Cashback

- 5% of your purchases at Indian Oil locations will be issued as Fuel Points (max 250 fuel points per month in the first 6 months, max 150 fuel points post 6 months from card issuance)

- 5% of your groceries and bill-paying expenditures as fuel points (max 100 fuel points per month on each category)

- For every Rs. 150 spent on all other purchases, you will receive 1 fuel point.

- On minimum fuel transactions of 400, a 1% fuel cost waiver is available.

Who Should Get an HDFC Bank Indian Oil Credit Card?

If you want to save money on fuel, this is the finest credit card for you because it has a lot of features and bonuses, especially for fuel spending. At Indian Oil locations, you may easily earn 5% of your expenses as gasoline points. You can also get 50 liters of free gas per year if you use this credit card.

However, if you’re searching for a credit card that gives you discounts at places other than IndianOil, this may not be the most optimal option for you. Then, you might be better off with the HDFC Regalia credit card (review) or the more premium HDFC Infinia credit card (review).

Eligibility Criteria

1. Age

Salaried

- Age: Between 21 and 60 years old

Self-employed

- The minimum age is 21 years old and the maximum age is 65 years old.

- ITR > Rs 6 lakhs per year in annual income

2. Income

- Monthly income of over Rs 10,000 – Salaried

- ITR of over Rs 6 lakhs per year – Self-employed

3. Location

Indian Resident

4. Documents

- Address Proof

- Ration Card

- Voter ID

- Passport

- Aadhaar card

- Proof of Identity

- Passport

- Driving License

- Aadhaar card

- Proof of Income

- Salary Slip

- IT Returns

- Form 16

Ratings and Reviews

- Cashback and Rewards 3/5 A 5% return is excellent, in numerous categories but the monthly restrictions on each are far too low.

- Fees and charges 4/5 The annual fee waiver on this card is pretty easy to accomplish. Treat as a lifetime free card even if you spend Rs 3-4,000 a month on fuel with it.

- Eligibility 4/5 Eligibility on this card, especially for salaried professionals, is super easy to get.

- Overall 3.5/5 Individuals that own a personal car or bike and fill up fuel up to around Rs 4-5,000 a month can get decent benefit from this credit card.

Conclusion

HDFC Bank is one of India’s most prestigious private banks. It provides a diverse range of products and services, including credit cards and other financial products. The HDFC Bank Indian Oil card gets you good value back at petrol pumps. However, if you are particularly looking for a credit card that gets you higher benefits on fuel as well as other spending, you should probably skip this one.

FAQs

Is the Indian Oil HDFC credit card good?

The Indian Oil HDFC Bank Credit Card is undoubtedly one of the best fuel credit cards in India, but it is not ‘the greatest’ for everyone due to the following major drawback: Fuel purchases made at non-Indian Oil gas stations do not earn Fuel Points at the same rate. Also, max caps on spending is a dealbreaker.

Which is the best credit card for fuel purchase?

Indian Oil Citi Platinum Card, HDFC Moneyback credit card, HDFC Bank Business MoneyBack credit card, ICICI Bank HPCL Coral credit card are some of the best credit cards for fuel purchase.

How can I redeem my HDFC Indian Oil credit card points?

Redeem Fuel Points for catalogue products via NetBanking (1 FP = up to 20 paise).

Redeem your Indian Oil HDFC Bank Credit Card Fuel Points for Cashback. (Redemption of Cashback Against Statement Balance, where 1 FP = 20 Paise)

What is the monthly interest rate on the HDFC Indian Oil credit card?

The monthly Interest rate of the HDFC Indian Oil Credit Card is 3.49%.

Are there any other fuel credit cards offered by HDFC Bank?

HDFC Bank Indian Oil Credit Card is the only fuel credit card offered by HDFC Bank. Read our review to make your decision.