On this page Show

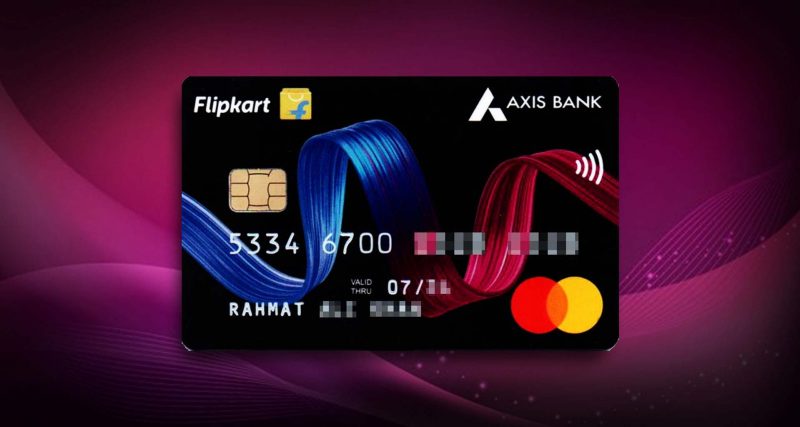

Flipkart Axis credit card is one of the hottest cars in the Indian market right now, and for all the good reasons. Launched in partnership with eCommerce giant Flipkart, this Axis credit card offers you unlimited 5% cashback on Flipkart and Flipkart entities (Myntra, 2GUD). That’s not all; you also get an enviable 4% cashback on preferred merchants and some more on all other spendings.

Here is our review of the Flipkart Axis credit card, where we dive deep into the pros, cons, rewards, cash back, and more. We attempt to answer the question of whether you should get one for yourself or not? Also, check Axis Ace credit card review.

Fees and Charges

| Label | Fees |

|---|---|

| Joining Fee | Rs 500 |

| Annual Fee | Rs 500 (waived off on spends over Rs 2 lakhs) |

| Interest Rate | 3.4% per month |

Pros and Cons

Every credit card has its own pros and cons, the Flipkart Axis credit card does too. Let’s have a look.

Rewards and Cashback

Flipkart Axis credit card is one of the most rewarding credit cards in India, if used at the right places. Let’s have a look at the most lucrative options to redeem the most benefits.

- Unlimited 5% cashback on Flipkart and Myntra

- Unlimited 4% cashback on “preferred merchants” – Cleartrip, Cure.fit, PVR, Swiggy, Tata 1mg, TataSky, and Uber. (subject to change)

- 1.5% on all other spending (except fuel, EMI, wallet reloads, etc)

Who Should Get Flipkart Axis Credit Card?

If you are an online shopping addict, especially if your majority spends are on Flipkart and Myntra, the Flipkart Axis credit card is a no-brainer for you. You can save 5% on all your shopping, making thousands in free money every year. On top of that, the easy annual fee waiver of Rs 2 lakhs (about 16,700 per month) can be achieved easily, making this card lifetime free for you. Here you can also, check HDFC Millennia credit card review.

Eligibility Criteria

Flipkart Axis credit card eligibility can be slightly vague at times. But Bankkaro helps make your process much smoother (apply now). Let’s check out the eligibility criteria for the card.

1. Age

- If you are a salaried individual – 18 years to 70 years.

- If you are a self-employed individual – 18 years to 70 years.

2. Occupation

- Self-employed Individuals

- Salaried individuals

3. Income

- Salaried- More than Rs 30,000 per month.

- Self-employed- More than Rs 30,000 per month.

4. Location

You should be living and working in one of the serviceable pin codes on Axis Bank’s website.

5. ID Proof (any one of the following)

- PAN Card

- Aadhaar Card

- Voter ID

- Driving License

- Passport

Ratings

Source: Flipkart

- Cashback and Rewards: 5/5

- Fees and charges: 5/5

- Eligibility: 3.5/5

- Overall: 4/5

Conclusion

As discussed, Flipkart Axis is one of, if not the best cashback credit cards in India right now. Not only does it offer up to 5% unlimited cash back on your online shopping and lifestyle expenses, it also gives it as statement credit as a straight discount on your credit card bill. If you shop on Flipkart and Myntra, even a few times a year, this is a card for your wallet.

That said, Flipkart Axis is strictly a card for cashback. Don’t go expecting any lifestyle or luxury benefits from it. It does give you 4 complimentary lounge visits at select airports, but that’s about it. There is nothing to write home about. So, if the discount is all that you want, go ahead and apply. Applying through Bankkaro gives you extra cashback over and above all the benefits you will avail yourself on the Flipkart Axis card once you get it!. Also, have a look at SBI simply clicks credit card review.